Why Should you Use Swing Trader?

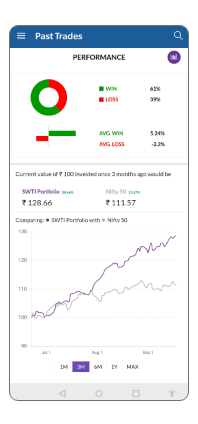

Excellent Returns

Portfolio delivered a CAGR* of 120% Vs 7% in NIFTY 50 in Past 1 Year

(* 1 Year period from 17 Sep 2019 to 16 Sep 2020)

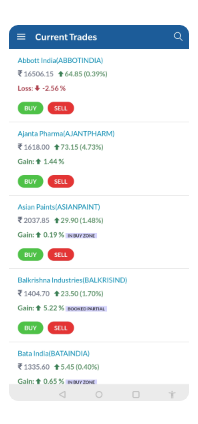

Maximized Risk-Reward Ratio

Most trades have a goal of 7% upside and 3% downside. Strategy is simple, alot

of small gains can add up to to big profits.

Easy to learn and use

Say hello to easier way of trading, simply follow the triggers to enter or exit

positions.

Discounted Price

Exclusive discounted subscription fees for IIFL Customers